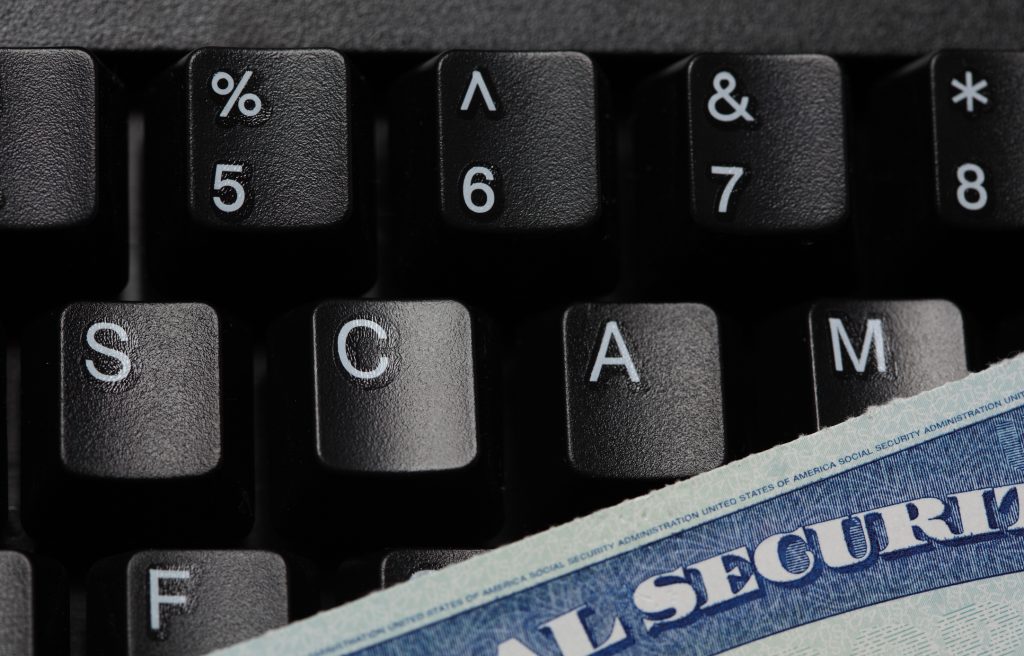

Turning 65 means a lot of great things – you’re eligible for Medicare, you’re at or near your full Social Security age, and of course you can get into some museums, buy Amtrak tickets, and eat at certain restaurants for a discounted price. Unfortunately, you may also be targeted by criminals trying to steal your Social Security number. It’s important to recognize what these common Social Security scams look and sound like so you can avoid them.

We all know how bad it is to have your identity stolen. You know to keep your Social Security card and number safe, but criminals are always developing new methods of tricking people. One method is by calling retirees and claiming to be a Social Security Administration employee. The caller might say that your Social Security number has been suspended due to fraudulent activity, and ask you to confirm your number or else payments will be suspended. Other times the caller might claim that the Social Security Administration’s computers are down, and the government needs to confirm your personal information in order to continue sending you payments.

You should also watch out for fraudulent emails asking you to click on a link that could download a virus or ask you to send your Social Security number. Keep in mind that the Social Security administration probably won’t email or call you asking for personal information if there is a problem with your account – they will send you a letter.

Keep in mind that there has been a change to Social Security, and you won’t necessarily receive benefits statements by mail. You can to go the Social Security website and create a “my Social Security” account. There you can review your earnings history and benefits statements regularly to make sure everything is correct. If a criminal changes your address and bank account information to steal your benefit, you can find out sooner by checking your account. You can also make sure that your earnings history is recorded correctly, as your benefit is based on the number or years you worked and your income during your highest earning 35 years.

Learning to recognize common Social Security scams can help you avoid them. Remaining alert and being proactive about threats can help you minimize your risk, and the same can be said about financial security planning. At SHP Financial, we can help you assess risks and create a comprehensive retirement plan. You can sign up for a complimentary review so that we can meet face to face and discuss your retirement preparedness, financial goals, and concerns.